Investing in stocks requires more than just luck or gut feelings; it demands reliable, up-to-date information and detailed analysis from trusted sources. A well-informed decision can be the difference between substantial gains and significant losses. That’s where stock research websites come into play. Did you know that investors who utilize comprehensive research tools and data analytics outperform those who don’t by up to 20%? With countless options available, finding the right platform that suits your needs can be overwhelming.

This guide covers the best stock research websites of 2024, offering in-depth insights into their features, pros and cons, pricing, and who they are best suited for. Whether you’re a beginner just starting, an active day trader, or a seasoned investor, this guide will help you choose the best tools to align with your investment strategy and financial goals.

What is the Best Stock Research Website?

When selecting a stock research website, it’s essential to consider factors such as ease of use, the depth of research tools, community insights, real-time data availability, and pricing. Here’s a quick snapshot of the top stock research websites of 2024 and what makes them stand out:

| Website | Best For | Key Features | Pricing |

|---|---|---|---|

| Stock Analysis | Best Overall | Advanced financial modeling, Real-time data, Comprehensive tools | Free and Premium Plans |

| The Motley Fool | Best for Paid Stock Recommendations | Stock picks, Educational content, Long-term investment strategies | Subscription Plans |

| Morningstar | Best for Mutual Funds | In-depth analysis, Mutual fund ratings, Stock research | Free and Premium Plans |

| Seeking Alpha | Best for Opinionated Research | Crowd-sourced insights, PRO content, Community-driven discussions | Free and PRO Plans |

| TradingView | Best for Charts and Technical Analysis | Advanced charting, Social trading features, Multiple asset coverage | Free and Premium Plans |

| Koyfin | Best Bloomberg Terminal Alternative | Powerful analytics, Comprehensive asset coverage, Customizable dashboards | Free and Premium Plans |

| Yahoo Finance | Best for the Latest News | Real-time data, News updates, Customizable watchlists | Free and Premium Plans |

| Zacks Investment Research | Best for Quantitative Stock Analysis | Proprietary Zacks Rank system, Earnings estimate revisions, Model portfolios | Premium and Ultimate Plans |

| Finviz | Best for Visual Stock Screening and Technical Analysis | Advanced stock screener, Heat maps, Visual tools, Real-time data | Free and Elite Plans |

This table provides a quick comparison of the best stock research websites, helping you identify which platform might be right for you. Now, let’s dive into a more detailed analysis of each platform to understand what makes them the best in their respective categories.

1. Best Overall: Stock Analysis

Stock Analysis stands out as the best overall stock research website in 2024, offering a comprehensive suite of tools, an intuitive interface, and robust data analytics capabilities. Whether you are a novice investor or an experienced trader, Stock Analysis provides a one-stop solution for your stock research needs. With a focus on advanced financial modeling, real-time data, and in-depth analysis, it equips investors with everything they need to make well-informed decisions.

Key Features of Stock Analysis

1. Advanced Financial Modeling Tools:

Stock Analysis excels with its advanced financial modeling capabilities, allowing investors to deeply analyze a company’s past performance and predict future outcomes. These models include detailed financial statements, balance sheets, cash flow statements, and profitability metrics—critical tools for conducting fundamental analysis and evaluating a stock’s intrinsic value.

2. Comprehensive Stock Screener:

The stock screener on Stock Analysis is one of the most powerful on the market. With a wide range of filters like market cap, P/E ratio, dividend yield, growth rates, and sector-specific metrics, this tool enables investors to quickly identify stocks that match their investment criteria, saving time and effort on manual research.

3. Real-Time Market Data and Alerts:

Staying updated with the latest market movements is crucial for investors. Stock Analysis provides real-time data, including stock prices, financial news, earnings reports, and economic indicators. Users can also set custom alerts to receive notifications about significant market events, price changes, or updates on their watchlisted stocks, ensuring they never miss a beat.

4. In-Depth Research Reports:

The platform offers in-depth research reports on individual stocks and sectors, prepared by seasoned analysts who cover key aspects like company financials, market trends, competitive positioning, and future growth prospects. These reports provide valuable insights for investors who rely on expert opinions and data-backed analysis.

5. User-Friendly Interface and Customization Options:

One of Stock Analysis’s standout features is its user-friendly interface, which is both easy to navigate and highly customizable. Investors can create personalized dashboards to track their portfolios, watchlists, and favorite stocks, offering a streamlined experience tailored to individual needs.

6. Educational Resources and Tools:

Stock Analysis also offers a wealth of educational resources, including tutorials, articles, and webinars, designed to help investors sharpen their skills. These resources are precious for beginners looking to deepen their understanding of stock investing and financial analysis.

Pros and Cons of Stock Analysis

Pros:

- A comprehensive set of tools for both beginners and advanced investors.

- Real-time market data with customizable alerts.

- Highly customizable and user-friendly interface.

- In-depth research reports by financial experts.

- Advanced stock screener with a wide range of filters.

Cons:

- Some advanced features are available only in the premium version.

- It may have a learning curve for complete beginners due to the depth of tools offered.

Pricing and Subscription Plans

Stock Analysis offers both free and premium subscription plans:

Free Plan: Provides access to essential tools like stock screeners, real-time data, and limited research reports.

Premium Plan: Priced at $9.99 per month for monthly billing or $79 per year for annual billing (equivalent to $6.58 per month). The premium plan unlocks advanced features such as comprehensive financial models, detailed research reports, and premium educational content.

For investors serious about their stock research, the premium plan offers substantial value at a competitive price.

Ideal User Profile: Who Should Use Stock Analysis?

Stock Analysis is ideal for:

- Active traders who need real-time data and advanced charting tools.

- Long-term investors focused on fundamental analysis and in-depth research.

- Beginners looking to learn and grow their investing skills with educational resources.

- Professional analysts are seeking advanced financial models and custom reporting features.

Stock Analysis provides a balanced combination of ease of use, powerful tools, and flexibility, making it a top choice for investors looking for a comprehensive stock research platform in 2024.

2. Best for Paid Stock Recommendations: The Motley Fool

The Motley Fool is widely recognized as the best stock research website for paid stock recommendations in 2024. Known for its long-standing history of helping investors achieve significant returns, The Motley Fool offers a blend of expertly curated stock picks, educational content, and comprehensive market analysis. It is particularly well-suited for investors who prefer guided investment advice and a long-term approach to building wealth.

Key Features of The Motley Fool

1. Stock Advisor and Rule Breakers Subscriptions:

The Motley Fool’s flagship products, Stock Advisor and Rule Breakers, provide monthly stock recommendations tailored to different investment styles. Stock Advisor focuses on well-established companies with solid fundamentals, while Rule Breakers targets high-growth stocks with disruptive potential. Both subscriptions offer in-depth analysis and a clear rationale for each pick, making them ideal for investors seeking carefully curated stock ideas.

2.Long-Term Investment Focus:

Unlike many platforms that cater to short-term trading strategies, The Motley Fool emphasizes a long-term investment approach. The platform recommends holding stocks for at least three to five years to maximize gains, reflecting the philosophy of legendary investors like Warren Buffett. This buy-and-hold strategy is appealing to those looking to build a stable, diversified portfolio over time.

3. Educational Resources and Investment Guides:

The Motley Fool provides a vast library of educational content, including articles, videos, podcasts, and webinars that cover a broad range of investment topics—from beginner’s guides to advanced market analysis. This educational focus helps investors make informed decisions and understand the reasoning behind each stock recommendation.

4. In-Depth Company and Market Analysis:

Every stock pick comes with a detailed analysis that covers the company’s financials, competitive landscape, growth prospects, and potential risks. The Motley Fool’s team of analysts conducts rigorous research to ensure each recommendation is backed by solid data and sound logic, offering subscribers a deep understanding of why a particular stock is chosen.

5. Access to Motley Fool’s Community and Forums:

Subscribers can join a vibrant community of like-minded investors through The Motley Fool’s forums. These forums provide a platform for discussing stock picks, sharing investment strategies, and getting feedback from other investors. This community aspect adds significant value to the subscription by fostering collaboration and continuous learning.

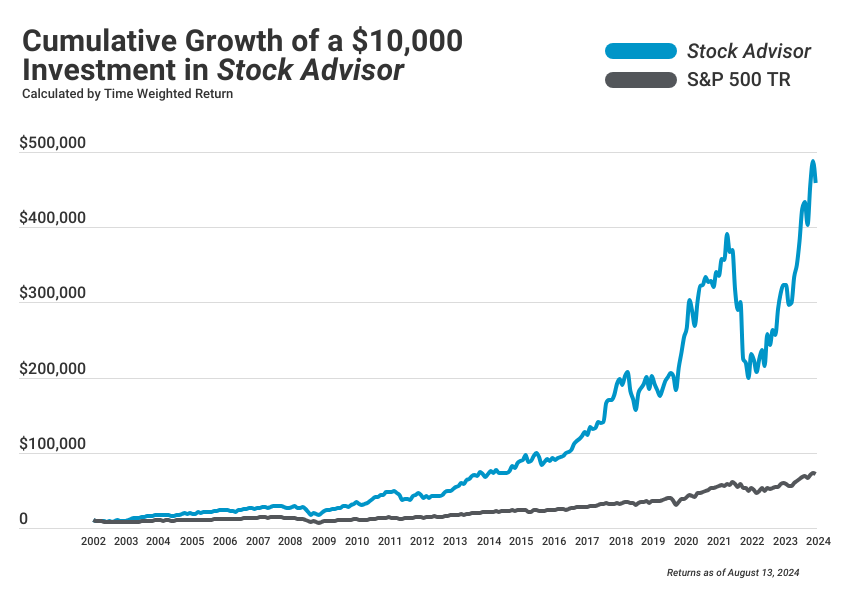

6. Performance Track Record:

The Motley Fool has a proven track record of delivering market-beating returns. For instance, the Stock Advisor portfolio has consistently outperformed the S&P 500. According to Motley Fool’s data, their picks have provided an average return of over 500% since inception, further solidifying their reputation as a reliable source of stock recommendations.

Pros and Cons of The Motley Fool

Pros:

- Proven track record of delivering high returns with well-researched stock picks.

- It gives an in-depth analysis and a clear investment rationale for each recommendation.

- Focus on long-term, buy-and-hold investment strategies.

- Access to a wealth of educational resources and a supportive investor community.

- Motley Fool provides regular updates and alerts on recommended stocks, including when to buy or sell.

Cons:

- Subscription fees can be relatively high for some investors.

- The emphasis on long-term investing may appeal to something other than short-term traders.

- Some stock picks may need to improve, requiring patience and a diversified portfolio approach.

Pricing and Subscription Plans

The Motley Fool offers several subscription plans to cater to different investor needs:

- Stock Advisor: $199 per year, featuring monthly stock recommendations, market analysis, and community access.

- Epic: $499 per year, includes everything in Stock Advisor plus additional stock picks, quant analytics, and portfolio strategies.

- Epic Plus: $1,999 per year, offers access to international stocks, value, options trading, and proprietary AI investing portfolios.

- Fool Portfolios: $3,999 per year, provides complete access to co-founder Tom Gardner’s portfolios, along with specialized research on crypto, microcaps, and more.

- Fool One: $13,999 per year, a comprehensive plan with access to all membership offerings, exclusive events, and the One Portfolio managed by their investing team.

- 1 Top Motley Fool Stock Report: $100 per report.

- 1 Stock Recommended by Stock Advisor: $100 per report.

While the subscription fees may seem high, many investors find them worthwhile, given the depth of analysis and historical performance.

Ideal User Profile: Who Should Use The Motley Fool?

The Motley Fool is best suited for:

- Long-Term Investors: Those looking for actionable stock recommendations with solid growth potential.

- Beginner to Intermediate Investors: Investors who value educational content and a guided approach to investing.

- Busy Professionals: Individuals who prefer curated advice and may need more time to conduct their research.

- Investors Seeking a Reputable Source: Those who want a reliable service with a proven track record of market-beating stock picks.

The Motley Fool’s emphasis on education, community, and long-term growth makes it a standout choice for investors looking to build a diversified portfolio based on expert stock recommendations rather than engaging in daily market speculation.

Conclusion:

For investors who prioritize long-term growth and want a reliable source of stock recommendations backed by thorough research, The Motley Fool is an excellent choice. Its blend of education, community, and proven performance makes it a valuable resource for both novice and experienced investors.

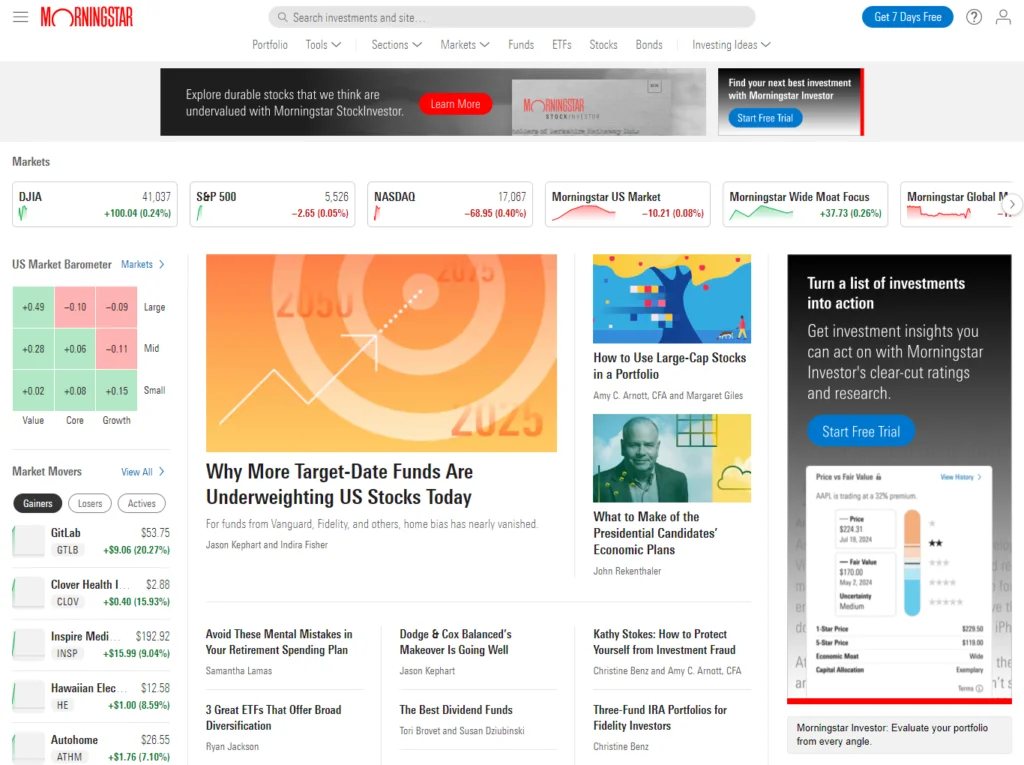

3. Best for Mutual Funds: Morningstar

Morningstar is widely recognized as the leading stock research website for investors interested in mutual funds, ETFs, and other diversified investment vehicles. Known for its rigorous research, in-depth analysis, and proprietary rating system, Morningstar has become a go-to platform for both individual and institutional investors aiming to make well-informed decisions. With over three decades of experience, Morningstar offers a wealth of data, research reports, and portfolio management tools designed to help investors maximize returns while managing risk effectively.

Key Features of Morningstar

1. Morningstar Rating System:

At the core of Morningstar’s offering is its proprietary Morningstar Rating System, often called the “star rating.” This system assigns ratings to mutual funds, stocks, and ETFs based on their historical risk-adjusted performance. Ratings range from one to five stars, with five-star funds considered the best-performing relative to peers. This straightforward metric allows investors to assess the quality and potential of various investment options quickly.

2. Comprehensive Mutual Fund Research:

Morningstar boasts an extensive database of mutual fund information covering thousands of funds across different categories, sectors, and geographies. Each fund is analyzed based on critical factors like management quality, fees, historical performance, risk profile, and asset allocation. This in-depth research is invaluable for investors looking to diversify their portfolios with a mix of active and passive investment vehicles.

3. Morningstar Analyst Reports:

For investors seeking more detailed insights, Morningstar offers in-depth analyst reports that cover a wide range of investments, including mutual funds, stocks, and ETFs. These reports, prepared by experienced analysts, provide forward-looking assessments of a fund or stock’s potential performance, management quality, and risk factors. Available to Morningstar Premium subscribers, these reports give investors an edge in making informed decisions.

4. Portfolio Management Tools:

Morningstar provides robust portfolio management tools that allow investors to track and analyze their investments comprehensively. The Portfolio X-Ray Tool is particularly valuable as it gives a detailed view of an investor’s Portfolio, including asset allocation, sector exposure, geographic distribution, and risk assessment. This tool helps investors identify potential overlaps or gaps in their portfolios, optimizing their asset mix for better risk-adjusted returns.

5. Investment Screeners and Filters:

The platform features powerful investment screeners that help users filter mutual funds, stocks, and ETFs based on criteria like performance, fees, sector, and risk. These customizable screeners allow investors to focus on specific metrics that align with their investment goals. For example, an investor searching for low-cost index funds can use filters to identify the best options based on expense ratios and historical performance.

6. Financial Planning and Retirement Tools:

Beyond its research capabilities, Morningstar also offers a suite of financial planning and retirement tools. These tools help investors project future income needs, assess risk tolerance, and recommend suitable asset allocations for retirement planning. This holistic approach makes Morningstar a valuable resource for those looking to achieve long-term financial security.

Pros and Cons of Morningstar

Pros:

- Trusted and widely recognized rating system for mutual funds and ETFs.

- Extensive database and in-depth analysis of mutual funds, stocks, and ETFs.

- Robust portfolio management tools, like the Portfolio X-Ray Tool.

- Detailed analyst reports providing forward-looking assessments.

- Educational content and tools for financial planning and retirement.

Cons:

- Some of the best features, such as detailed reports and advanced tools, are only available with the Premium subscription.

- The sheer volume of data and tools can be overwhelming for novice investors.

- Less focused on short-term trading; better suited for long-term investors.

Pricing and Subscription Plans

Morningstar offers a freemium model with both free and premium subscription options:

- Free Plan: Provides access to essential information, news, and limited research on mutual funds, stocks, and ETFs.

- Premium Plan: Priced at $34.95 per month or $249 per year. This subscription includes access to detailed Morningstar Analyst Reports, the Portfolio X-Ray Tool, and premium stock and mutual fund screeners. This plan is ideal for serious investors who want to dive deeper into their research and leverage Morningstar’s full capabilities.

The Premium subscription is highly recommended for those who actively manage their investments and seek top-tier research and analytical tools.

Ideal User Profile: Who Should Use Morningstar?

Morningstar is best suited for:

- Long-Term Investors: Those focused on mutual funds, ETFs, and diversified portfolios.

- Financial Advisors and Planners: Professionals who require in-depth analysis and research reports for client recommendations.

- DIY Investors: Individuals who prefer managing their portfolios and need robust tools for monitoring and optimization.

- Retirement-Focused Investors: Those looking for comprehensive planning tools and low-risk investment options.

Morningstar’s reputation for rigorous analysis, robust portfolio tools, and an intuitive rating system makes it a top choice for mutual fund and ETF investors aiming to make informed decisions and achieve long-term financial success.

Conclusion:

For investors who prioritize comprehensive research, in-depth analysis, and a reliable rating system, Morningstar offers unparalleled value. Whether you are a long-term investor, a financial advisor, or planning for retirement, Morningstar provides the tools and insights needed to make confident investment choices.

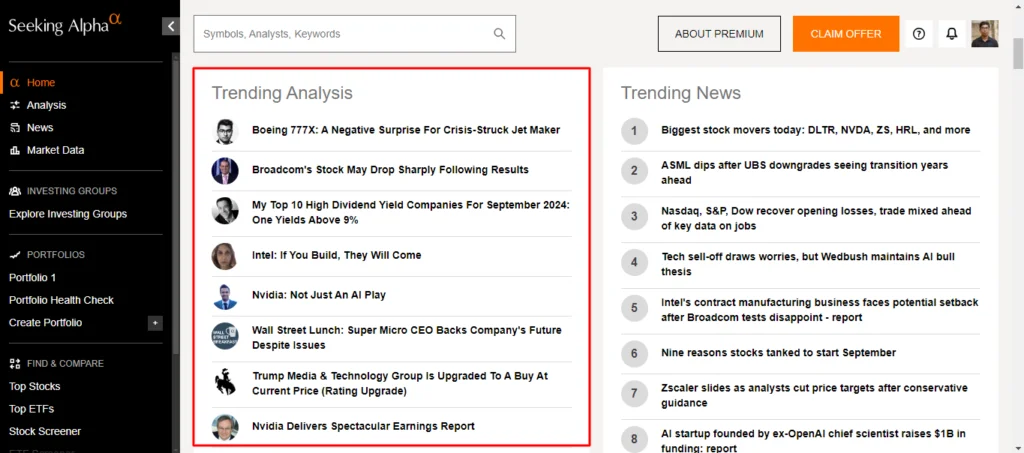

4. Best for Opinionated Research: Seeking Alpha

Seeking Alpha stands out as the best stock research website for investors who value opinionated research and diverse perspectives. Unlike traditional stock research websites that focus solely on data, Seeking Alpha offers a platform where investors, financial analysts, and market enthusiasts share their insights and opinions. This crowd-sourced content model allows users to gain various viewpoints, helping them form a more comprehensive understanding of market trends, stocks, and investment strategies.

Key Features of Seeking Alpha

1. Crowd-Sourced Content and Analysis:

Seeking Alpha’s strength lies in its crowd-sourced content, with thousands of contributors, including professional analysts and individual investors, publishing articles on stock analysis, market outlooks, earnings predictions, and investment strategies. This feature is precious for investors who prefer opinionated research backed by diverse perspectives rather than just raw data.

2. Seeking Alpha PRO Subscription:

For those seeking deeper insights, Seeking Alpha offers a PRO subscription that includes access to exclusive content such as top-rated articles, in-depth stock research, and quantitative ratings that help identify strong buy or sell opportunities. The subscription also provides enhanced tools like earnings call transcripts, author ratings, and a curated newsletter for advanced investors.

3. Quant Ratings and Factor Scores:

Seeking Alpha’s Quant Ratings uses a data-driven approach to evaluate stocks based on five core metrics: value, growth, profitability, momentum, and earnings revisions. These ratings offer an unbiased assessment of stocks, which can serve as an additional tool for making informed decisions. Factor scores provide a detailed breakdown of each metric, giving investors a clearer picture of a stock’s strengths and weaknesses.

4. Earnings Call Transcripts and Analysis:

The platform provides earnings call transcripts and analyses that offer insights into a company’s performance, future outlook, and management strategies. Access to these transcripts can be crucial for investors who want to stay ahead of quarterly earnings releases and understand market reactions to these events.

5. Robust Community and Comment Section:

Seeking Alpha’s active community is one of its standout features. The comment section under each article allows for engaging discussions among investors and contributors. This community-driven aspect is invaluable for those who like to debate ideas, challenge assumptions, and validate their investment theses against diverse opinions.

6. Stock Screener and Portfolio Monitoring:

Seeking Alpha provides user-friendly stock screeners and portfolio monitoring tools that help investors track stocks, analyze performance, and monitor critical events like earnings releases or dividend announcements.

Pros and Cons of Seeking Alpha

Pros:

- A diverse range of viewpoints from thousands of contributors.

- Access to exclusive content with the PRO subscription.

- Quant Ratings provide an unbiased, data-driven perspective.

- Active community fosters in-depth discussions and debates.

- Earnings call transcripts and detailed stock analyses.

Cons:

- Some articles may have biased or overly opinionated perspectives.

- The free version has limited access to premium content.

- Requires a discerning eye to differentiate between valuable insights and noise.

Pricing and Subscription Plans

Seeking Alpha offers a freemium model where users can access some content for free, while more detailed analysis and tools are available through paid subscriptions:

- Premium Plan: It offers $4.95 for the first month, then $239 per year. This plan includes premium articles, exclusive stock picks, and advanced data tools.

- PRO Plan: $99 for the first month, then $2,400 per year. The PRO plan unlocks top analyst insights, exclusive coverage, and enhanced data tools.

These plans provide significant value for serious investors looking for community insights and professional-grade analysis.

Ideal User Profile: Who Should Use Seeking Alpha?

Seeking Alpha is best suited for:

- Investors who value diverse perspectives enjoy reading opinionated research.

- Active traders are looking for detailed analysis and stock recommendations from experienced contributors.

- Advanced investors are interested in using quantitative data to supplement their decision-making process.

- It’s also suitable for community-driven users who want to be part of an active investor network.

Seeking Alpha leverages the collective wisdom of a vast community, making it the go-to platform for those who appreciate well-argued research rather than just numbers. Explore Seeking Alpha’s free trial to experience the diverse range of opinionated research and community insights.

Conclusion:

For investors who value diverse opinions and in-depth research from experienced contributors, Seeking Alpha offers a unique blend of crowd-sourced insights and quantitative analysis tools that can help you stay ahead in the stock market.

5. Best for Charts and Technical Analysis: TradingView

TradingView stands out as the best stock research website for charts and technical analysis in 2024. With its cutting-edge charting tools, social trading features, and real-time data across multiple asset classes, TradingView is the platform of choice for active traders, technical analysts, and anyone relying heavily on chart patterns and technical indicators to make trading decisions.

Key Features of TradingView

1. Advanced Charting Tools:

TradingView provides some of the most advanced and customizable charting tools available. Users can select from various chart types—such as candlestick, bar, line, Renko, and Heikin Ashi—to analyze price movements. The platform also supports over 100 built-in technical indicators, including moving averages, Bollinger Bands, and RSI, along with an extensive library of community-built indicators.

2. Custom Scripts and Pine Script Programming Language:

A standout feature of TradingView is its Pine Script programming language, which allows users to create custom indicators, strategies, and alerts. This flexibility is invaluable for advanced traders who want to backtest their trading ideas and automate strategies. The large community of developers who share custom scripts also adds significant value by providing access to unique tools and indicators.

3. Social Trading and Community Features:

TradingView is more than just a charting platform; it’s also a social network for traders. Users can share their charts, strategies, and market insights with the community, follow other traders, and participate in discussions about market trends. This collaborative environment helps traders learn from each other and stay updated on the latest market sentiment.

4. Real-Time Data and Multi-Asset Coverage:

With real-time data for stocks, forex, cryptocurrencies, futures, and commodities, TradingView caters to traders who deal with multiple asset classes. While Covering over 50 global exchanges, the platform provides a comprehensive view of international financial markets, making it a versatile tool for global traders.

5. Alerts and Notifications:

TradingView allows users to set custom alerts based on specific conditions, such as price movements, indicator values, or drawing tool interactions. Alerts can be sent via email, SMS, or in-app notifications, ensuring traders never miss a trading opportunity.

6. Paper Trading and Strategy Backtesting:

The platform offers a paper trading feature that enables users to practice their strategies in a risk-free environment using virtual money. This feature is ideal for beginners or traders looking to test new strategies. Additionally, TradingView supports strategy backtesting, allowing traders to evaluate the historical performance of their trading algorithms.

Pros and Cons of TradingView

Pros:

- It has Industry-leading charting tools and extensive customization options.

- Support for custom scripts and strategy development via Pine Script.

- TradingView offers real-time data across multiple asset classes and global exchanges.

- Social trading features that foster a collaborative trading community.

- It has alerts and notifications for real-time trading opportunities.

Cons:

- The free version has limited features and data access.

- Advanced features like multiple chart layouts and real-time market data require a premium subscription.

- The vast array of tools and settings may overwhelm beginners.

Pricing and Subscription Plans

TradingView offers a range of subscription plans tailored to different types of traders:

- Free Plan: Basic access with ads, limited indicators per chart, and delayed market data.

- Pro Plan: It offers $14.95 per month or $155.40 per year, providing more indicators per chart, additional data sources, and faster data updates.

- Pro+ Plan: This plan offers $29.95 per month or $299.40 per year, offering additional chart layouts, real-time data, and faster customer support.

- Premium Plan: It offers $59.95 per month or $599.40 per year, including a full suite of features such as up to 25 indicators per chart, unlimited alerts, priority customer support, and multi-monitor support.

Of severe traders focused on technical analysis and custom strategy development, the Pro+ or Premium plans offer the most value with their extensive features and real-time data access.

Ideal User Profile: Who Should Use TradingView?

TradingView is best suited for:

- Technical Analysts: These are those who need advanced charting tools and indicators to analyze price movements.

- Active Traders: Individuals looking for real-time data and custom alerts across multiple asset classes.

- Developers and Quants: Traders interested in writing and testing custom trading scripts and algorithms.

- Social Traders: Users who want to share their ideas and collaborate with a global community of traders.

TradingView provides a comprehensive platform combining cutting-edge technical analysis tools, real-time data, and social trading features, making it an essential tool for traders who thrive on charts and data-driven strategies.

Conclusion:

For traders and technical analysts who rely heavily on chart patterns, technical indicators, and community insights, TradingView is a leading platform that offers everything needed for effective decision-making and strategy development.

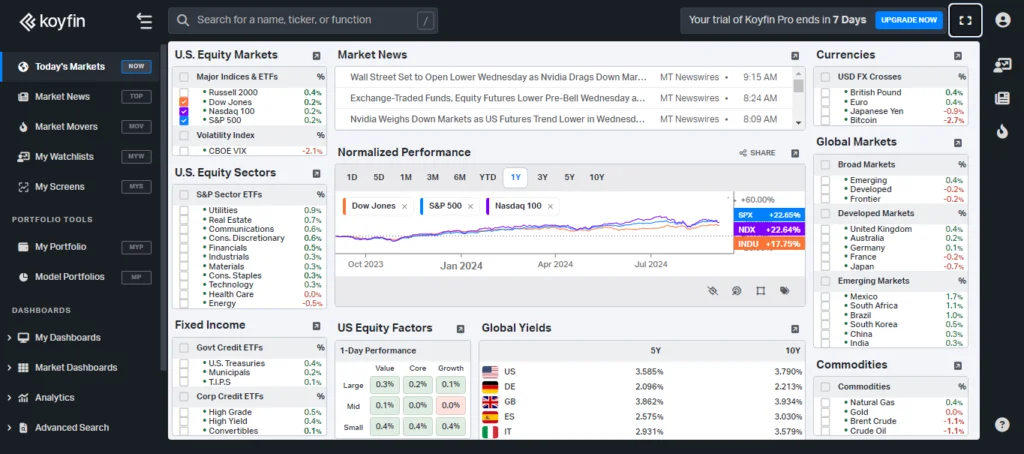

6. Best Bloomberg Terminal Alternative: Koyfin

Koyfin has emerged as the leading alternative to the Bloomberg Terminal in 2024 for investors and financial professionals seeking advanced analytics, comprehensive financial data, and customizable dashboards without the hefty price tag. With its powerful suite of tools, Koyfin caters to users who want to conduct deep market analysis across multiple asset classes, making it a robust yet affordable research tool.

Key Features of Koyfin

1. Comprehensive Financial Data Coverage:

Koyfin offers extensive data across multiple asset classes, including stocks, ETFs, mutual funds, fixed income, commodities, and cryptocurrencies. This comprehensive coverage allows users to analyze and compare various asset types on a single platform, providing a holistic view of the financial markets.

2. Advanced Charting and Visualization Tools:

Known for its advanced charting capabilities, Koyfin enables users to visualize data using line charts, bar charts, heat maps, scatter plots, and correlation matrices. These tools are essential for both technical and fundamental analysis, helping users identify trends, analyze market behavior, and make data-driven investment decisions.

3. Customizable Dashboards and Workspaces:

One of Koyfin’s standout features is its highly customizable dashboards. Users can create multiple workspaces to monitor specific stocks, sectors, or asset classes tailored to their unique needs. Dashboards can be configured with a range of widgets, such as real-time data, financial metrics, economic indicators, and custom watchlists, providing an at-a-glance view of the markets.

4. Robust Stock and Macro Screeners:

Koyfin’s robust stock and macro screeners allow users to filter assets like stocks and ETFs based on valuation, growth, profitability, dividends, and technical indicators. For macroeconomic analysis, the platform provides screeners that filter by economic data, enabling users to gauge market conditions and macro trends.

5. Earnings and Financial Analysis:

The platform offers detailed earnings and financial analysis tools, covering vital metrics such as revenue growth, profit margins, debt levels, and return on equity. Users can access earnings call transcripts and visualize earnings trends over time, providing deeper insights into a company’s performance and future potential.

6. Sector and Industry Analysis:

Koyfin allows users to conduct sector and industry analysis to identify top-performing sectors and compare them against others. It is beneficial for top-down investors who focus on macro trends and wish to allocate their investments accordingly.

7. Institutional-Grade Data at a Fraction of the Cost:

While the Bloomberg Terminal can cost upwards of $20,000 per year, Koyfin delivers a similar level of data and analysis tools at a fraction of the price. This affordability makes Koyfin an attractive option for individual investors, small firms, or financial professionals who need institutional-grade data without the high costs.

Pros and Cons of Koyfin

Pros:

- It has comprehensive coverage across stocks, ETFs, fixed income, commodities, and more.

- Koyfin has advanced charting and visualization tools with extensive customization options.

- It provides robust screeners for both stock and macroeconomic analysis.

- Koyfin has customizable dashboards that offer a tailored experience for each user.

- Affordable pricing compared to the Bloomberg Terminal.

Cons:

- Some features and data sets are still in development and may not match Bloomberg’s extensive offerings.

- The powerful interface can have a steep learning curve for beginners.

- Limited support for certain niche asset classes compared to Bloomberg’s vast data coverage.

Pricing and Subscription Plans

Koyfin offers a tiered subscription model tailored to different user needs:

- Free Plan: Provides access to essential data, limited charting tools, and fundamental analysis features.

- Plus Plan: Priced at $49 per month or $39 per month when billed annually. This plan includes enhanced charting, additional data points, and more customization options.

- Pro Plan: Priced at $110 per month or $79 per month when billed annually. This plan unlocks the full range of Koyfin’s features, including advanced analytics, macro data, custom dashboards, and expanded data coverage. It is ideal for professional investors and analysts who need comprehensive data and insights.

For users seeking high-quality financial data and analysis without spending tens of thousands of dollars, Koyfin’s Pro Plan offers exceptional value.

Ideal User Profile: Who Should Use Koyfin?

Koyfin is best suited for:

- Financial Professionals: Those looking for a cost-effective alternative to the Bloomberg Terminal.

- Individual Investors: Users who need advanced charting, data visualization, and financial analysis tools.

- Macro and Top-Down Investors: Investors focus on macro trends and require comprehensive data on economic indicators and sector performance.

- Active Traders and Analysts: These are those who rely on customizable dashboards and data-driven insights for decision-making.

With its powerful analytics, customizable interface, and affordable pricing, Koyfin bridges the gap between retail and institutional investors, providing access to institutional-grade tools and data without prohibitive costs.

Conclusion:

Koyfin is a game-changer for investors who need powerful analytical tools and extensive market coverage without the hefty price of traditional terminals. Whether you’re a financial professional or an individual investor, Koyfin offers a compelling package of features that can enhance your market analysis and investment strategies.

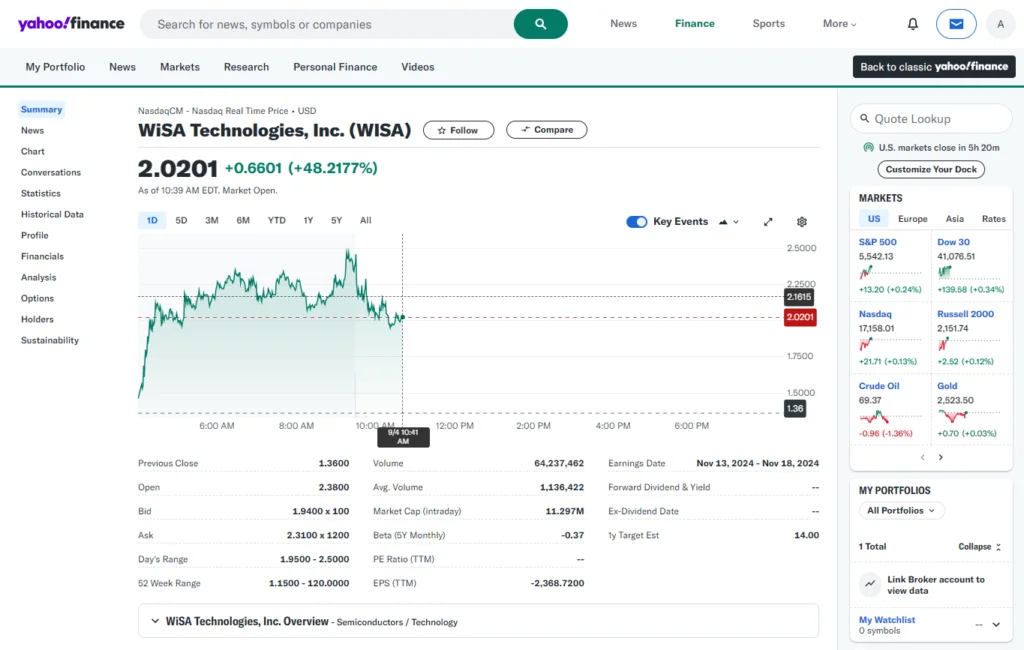

7. Best for the Latest News: Yahoo Finance

Yahoo Finance has long been a trusted name in financial news and research, and it continues to be a top choice for investors who prioritize staying updated with the latest market news. Offering a blend of real-time stock quotes, comprehensive financial news, and in-depth data on individual stocks, Yahoo Finance remains an invaluable tool for investors seeking quick and accurate updates on market movements.

Key Features of Yahoo Finance

1. Real-Time Stock Quotes and Financial News:

Yahoo Finance provides real-time stock quotes and up-to-the-minute financial news from reputable sources like Reuters, Bloomberg, and Associated Press. It ensures investors have access to the latest information that could affect their investment decisions. The platform covers major financial events, earnings announcements, economic data releases, and geopolitical developments, offering a holistic view of global markets.

2. Customizable Watchlists and Alerts:

Users can create custom watchlists to monitor their favorite stocks, ETFs, mutual funds, and cryptocurrencies. Additionally, the platform allows price alerts and notifications for specific stocks or market events to be set. It is beneficial for active traders who need to react quickly to market changes.

3. In-Depth Stock Data and Historical Performance:

Yahoo Finance offers comprehensive data on individual stocks, including historical performance, key statistics, financials, earnings, dividends, and insider activity. Interactive charts enable users to analyze historical trends, compare multiple stocks, and apply various technical indicators to understand a stock’s performance over time better.

4. Yahoo Finance Premium:

For those seeking more advanced analysis, Yahoo Finance Premium provides access to enhanced charting tools, exclusive research reports, portfolio analytics, and fair value analysis. The Premium plan also offers proprietary investment ideas, risk analysis, and detailed breakdowns of earnings reports, catering to severe investors who need more than just primary data and news.

5. Financial Calculators and Tools:

The platform includes various financial calculators and tools for everything from retirement planning to mortgage calculations. These tools are precious for individual investors who want to manage their finances and plan for the future alongside their investment portfolios.

6. Community Insights and Expert Opinions:

Yahoo Finance features a vibrant community where investors share their insights, opinions, and analyses in the comment sections of articles and stock pages. This community-driven content, combined with expert analysis from financial journalists and market experts, provides a well-rounded perspective on different stocks and market events.

7. Mobile App for On-the-Go Access:

The Yahoo Finance mobile app offers all the features of the desktop version, including real-time quotes, customizable watchlists, news updates, and interactive charts. It ensures that investors can stay informed and manage their portfolios even while on the move.

Pros and Cons of Yahoo Finance

Pros:

- It provides comprehensive real-time data and financial news from reputable sources.

- Yahoo Finance has a user-friendly interface with customizable watchlists and alerts.

- It has features like in-depth stock data, interactive charts, and financial analysis tools.

- Yahoo Finance offers affordable premium subscriptions with advanced features and exclusive content.

- Mobile app ensures easy access to market information on the go.

Cons:

- Some advanced features, like proprietary research reports and in-depth analytics, are only available with the Premium subscription.

- It needs some advanced technical analysis tools, which are available on platforms like TradingView.

- The free version has ads that may detract from the user experience.

Pricing and Subscription Plans

Yahoo Finance offers both free and premium subscription options:

- Free Plan: Provides access to essential stock quotes, financial news, historical data, and interactive charts. However, the free version includes ads and lacks some advanced features.

- Bronze Plan: Priced at $9.95 per month or $7.95 per month when billed annually ($95.40 per year), this plan includes portfolio performance analysis, volatility risk exposure, and ad-free experience.

- Silver Plan: Priced at $24.95 per month or $19.95 per month when billed annually ($239.40 per year), it includes access to premium news, research reports, and model portfolio strategies.

- Gold Plan: Priced at $49.95 per month or $39.95 per month when billed annually ($479.40 per year), it offers advanced features such as personalized trade ideas, historical financial data, and technical analysis tools.

For investors who rely heavily on real-time news, data, and analysis to make quick decisions, the Premium subscription options, notably the Gold plan, offer significant value.

Ideal User Profile: Who Should Use Yahoo Finance?

Yahoo Finance is best suited for:

- News-Driven Investors: Investors who prioritize staying informed about the latest financial news and market events to make timely, well-informed decisions.

- Beginners and Intermediate Investors: Individuals looking for an easy-to-use platform with comprehensive data and analysis tools.

- Active Traders: It is best for traders who rely on real-time stock quotes and alerts to make quick, informed trading decisions.

- Cost-Conscious Investors: Investors seeking a free or low-cost option for basic stock research, news, and portfolio tracking.

With its robust combination of real-time data, financial news, comprehensive stock analysis, and a user-friendly interface, Yahoo Finance remains a popular and reliable platform for both novice and seasoned investors.

Conclusion:

If you are an investor who values up-to-date financial news, real-time market data, and a platform that is easy to navigate, Yahoo Finance offers a compelling solution. Consider exploring the Premium options for an even deeper dive into market insights and analysis.

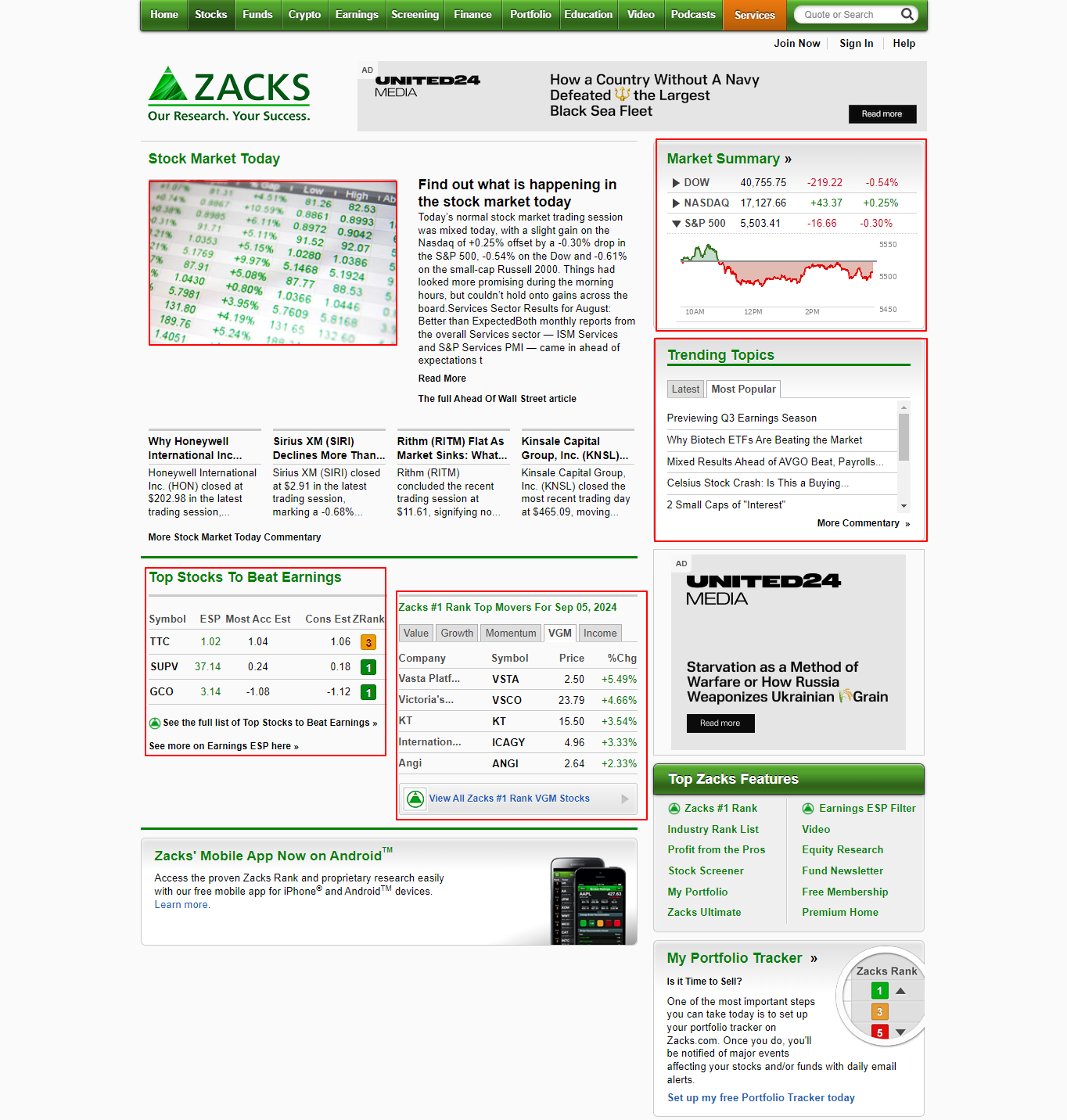

8. Best for Quantitative Stock Analysis: Zacks Investment Research

Zacks Investment Research stands out as a top choice for investors who rely on a quantitative approach to stock selection. Renowned for its data-driven stock-rating system and focus on earnings estimate revisions, Zacks offers a combination of actionable stock picks, in-depth research reports, and robust screening tools designed for those who seek to outperform the market through a strategic, numbers-focused approach.

Key Features of Zacks Investment Research

1. Zacks Rank stock-rating System:

Zacks’ proprietary Zacks Rank system is the cornerstone of its platform. This subscription-based service ranks stocks from #1 (Strong Buy) to #5 (Strong Sell) based on earnings estimate revisions. Historical data indicates that stocks rated #1 (Strong Buy) have consistently outperformed the S&P 500, making this tool highly valuable for investors seeking data-backed stock recommendations.

2. Emphasis on Earnings Estimates and Revisions:

Unlike many platforms that offer general market data, Zacks focuses on a quantitative strategy centered around earnings estimate revisions. These revisions are often leading indicators of a stock’s future performance. By leveraging this data, Zacks provides timely stock picks that can help investors identify undervalued opportunities.

3. Comprehensive Research Reports and Tools:

Zacks offers an extensive library of research reports on stocks, mutual funds, and ETFs. These reports provide a detailed analysis of financials, growth prospects, valuation metrics, and risks. For investors who prefer an in-depth examination, these resources are invaluable for making well-informed decisions.

4. Diverse Model Portfolios and Investment Strategies:

Subscribers can access a range of model portfolios and investment strategies tailored to different objectives, such as growth, value, momentum, income, and aggressive growth. These portfolios are regularly updated based on the Zacks Rank and other proprietary indicators, offering a hands-on approach to diversified investing.

5. Advanced Stock Screeners and Premium Tools:

Zacks’ advanced stock screeners allow users to filter stocks based on criteria like Zacks Rank, sector, valuation, and other metrics. Premium subscribers gain access to tools like the Focus List Stocks, which identifies top-positioned stocks, and Earnings ESP, which targets stocks with the highest chances of positive earnings surprises.

6. Proven Performance Track Record:

Zacks has a strong track record of delivering market-beating returns. According to their data, stocks ranked #1 (Strong Buy) have historically generated an average annual return of +24.75%. This impressive performance underscores the value of Zacks’ quantitative approach for investors looking to maximize their returns.

Pros and Cons of Zacks Investment Research

Pros:

- They have a proven quantitative stock-rating system with a history of market outperformance.

- It has detailed earnings estimate revisions and forecast data for actionable insights.

- Access to comprehensive research reports, model portfolios, and premium stock picks.

- Zacks offers screening tools to filter stocks based on Zacks Rank and other financial metrics.

- It regularly updates stock recommendations and market trend analyses.

Cons:

- Subscription costs can be high for some investors, especially for advanced plans.

- Emphasis on quantitative analysis may not appeal to those who prefer a qualitative approach.

- Some stock picks may underperform, necessitating a diversified portfolio and careful risk management.

Pricing and Subscription Plans

Zacks Investment Research offers several subscription options:

- Zacks Premium: $249 per year. It includes access to the Zacks Rank List, Equity Research Reports, Earnings ESP Filter, and Focus List Stocks.

- Zacks Investor Collection: This plan offers $59 per month or $495 per year. It provides access to all long-term investor portfolios and premium research tools for stocks, ETFs, and mutual funds.

- Zacks Ultimate: It costs $299 per month or $2,995 per year. The ultimate plan combines all of Zacks’ trading services, from value and growth to options and income strategies.

- Other Services: Specialized advisory services like Research Wizard (free trial available) and Zacks Method for Trading ($39 for the Home Study Course) offer additional strategies for various investor needs.

While the subscription fees may seem steep, the platform’s solid historical performance and in-depth analysis make Zacks Investment Research a valuable tool for serious investors.

Ideal User Profile: Who Should Use Zacks Investment Research?

Zacks Investment Research is ideal for:

- Intermediate to Advanced Investors: Those who value a data-driven, quantitative approach to stock selection.

- Active Traders: Individuals who capitalize on earnings revisions and market momentum.

- Growth and Value Investors: Investors seeking stocks with high potential based on earnings estimate data.

- Investors Seeking Diversified Strategies: Zacks Investment Research is best for those people who are looking for model portfolios and specialized advisory services.

Zacks’ emphasis on quantitative analysis, its proven track record, and its focus on earnings estimates make it an excellent choice for investors looking for data-backed stock recommendations.

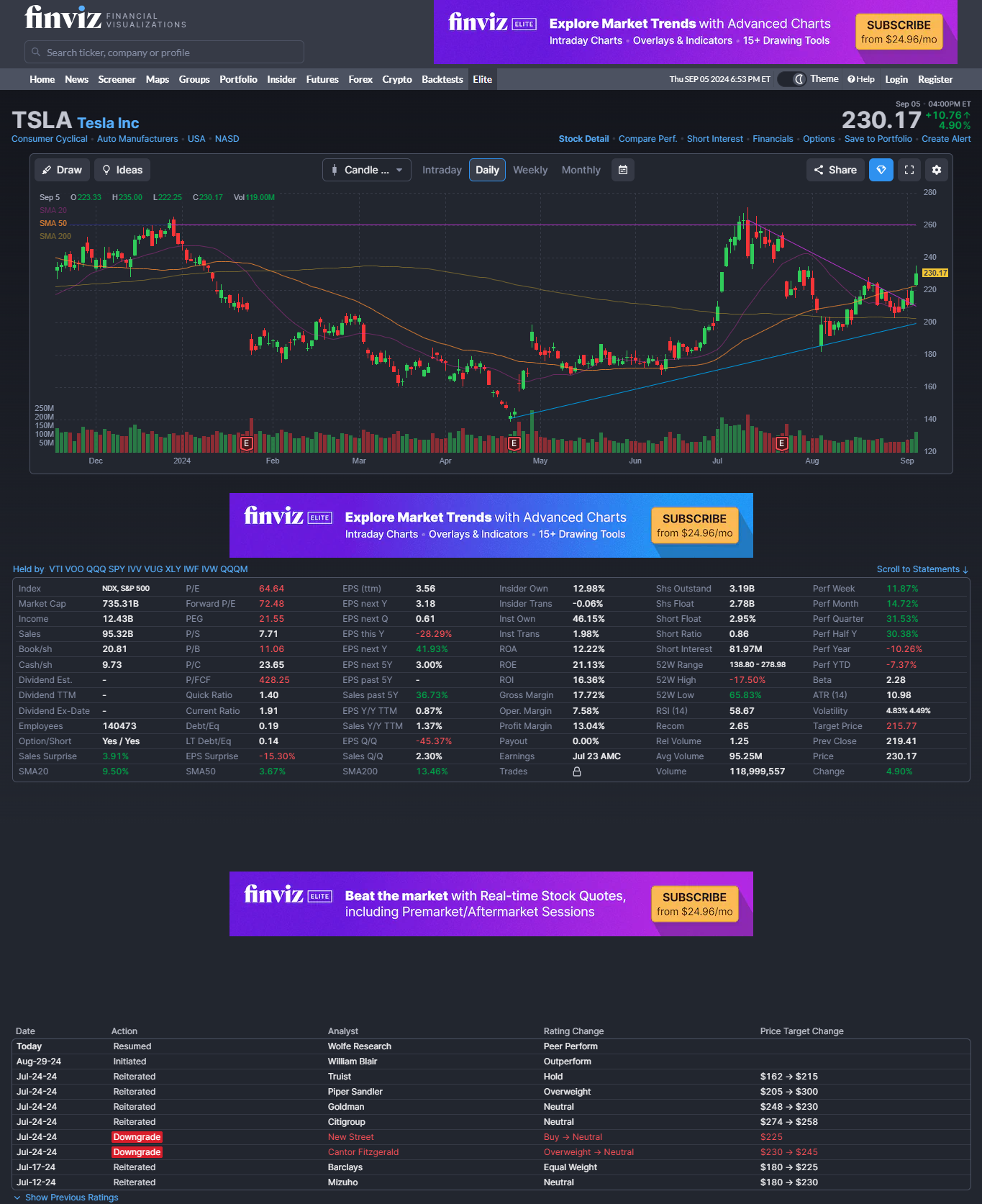

9. Best for Visual Stock Screening and Technical Analysis: Finviz

Finviz (Financial Visualizations) has established itself as the leading platform for visual data representation, advanced stock screening, and technical analysis. Known for its intuitive interface, Finviz caters to both beginner and experienced traders who prefer visual tools to understand market trends, identify trading opportunities, and analyze stocks from multiple perspectives.

Key Features of Finviz

1. Advanced Stock Screener:

Finviz’s flagship product is its highly customizable stock screener. It allows users to filter stocks based on fundamental, technical, and descriptive criteria such as price, market cap, P/E ratio, dividend yield, average volume, and chart patterns. This flexibility makes it easy for investors to find stocks that match their specific criteria, whether they are looking for undervalued stocks, high-dividend payers, or momentum plays.

2. Heat Maps and Data Visualization:

Finviz stands out for its emphasis on visual data representation. Its popular heat maps provide a color-coded overview of market performance by sector, industry, and asset type. This feature is handy for investors who want to quickly gauge overall market sentiment or identify trends within specific sectors.

3. Finviz Elite Subscription:

For those who need more advanced tools, Finviz Elite offers real-time data, advanced charting tools, pre-market and after-hours data, backtesting capabilities, and custom alerts. These features make it ideal for active traders and day traders who need immediate access to the latest market data and insights to make timely decisions.

4. Technical Analysis and Charting Tools:

Finviz offers robust technical analysis tools that allow users to create and customize charts, identify patterns, and use various indicators like moving averages, Bollinger Bands, MACD, RSI, and more. This tool makes it a preferred platform for traders focused on technical analysis and short-term trading strategies.

5. News Aggregator and Insider Trading Data:

Finviz aggregates news from multiple financial sources, providing users with the latest headlines that could impact their investment decisions. Additionally, it offers insights into insider trading activity, which can be a critical indicator of a company’s potential performance.

6. Backtesting and Strategy Development:

With Finviz Elite, users can backtest their trading strategies using historical data to evaluate how they would have performed in past market conditions. This feature is invaluable for technical traders who want to refine their strategies before committing capital.

Pros and Cons of Finviz

Pros:

- Highly customizable stock screener with extensive filtering options.

- Visual tools like heat maps and bubble charts provide intuitive market insights.

- Real-time data, alerts, and advanced charting are available with Finviz Elite.

- Backtesting and strategy development tools for refining trading approaches.

- User-friendly interface that is easy to navigate, even for beginners.

Cons:

- The free version offers limited features and delayed data.

- It primarily focuses on technical analysis, with less emphasis on in-depth fundamental analysis, compared to platforms like Morningstar or Zacks.

- Some features, like backtesting and custom alerts, are only available with the Finviz Elite subscription.

Pricing and Subscription Plans

Finviz offers a tiered pricing model:

- Free Plan: Access to essential stock screening, charts, and news, but with delayed data and ads.

- Registered Plan: Free, but requires registration. It includes basic features like creating portfolios and limited screener presets.

- Finviz Elite: Priced at $39.50 per month or $299.50 per year (equivalent to $24.96 per month when billed annually). This plan includes real-time data, advanced charting, backtesting, pre-market and after-hours data, and an ad-free experience.

For active traders who require real-time data and advanced technical tools, the Elite subscription offers significant value at an affordable price.

Ideal User Profile: Who Should Use Finviz?

Finviz is best suited for:

- Day Traders and Swing Traders: It is best for those traders who need real-time data, custom alerts, and technical analysis tools.

- Technical Analysts: Traders who rely on chart patterns, trend lines, and indicators to make trading decisions.

- Investors Seeking Visual Data Representation: Finviz is best for those investors who prefer visual tools like heat maps and bubble charts for quick market insights.

- Beginner to Intermediate Investors: Individuals seeking a user-friendly, cost-effective tool for stock screening and technical analysis.

Conclusion:

Finviz’s emphasis on data visualization, advanced screening, and technical analysis makes it a standout choice for traders and technical analysts who rely heavily on charts and visual market insights. Its combination of a user-friendly interface and powerful features provides substantial value to both novice and experienced traders looking for a visually oriented stock research tool.

How to Choose the Best Stock Research Website for Your Needs

Choosing the right stock research website depends largely on your investment goals, experience level, budget, and preferred research style. With numerous options available, it’s crucial to consider what features and services you need most. Below are vital factors to guide you in selecting the right stock research website:

1. What Type of Investor Are You?

Understanding your investor profile is crucial in determining the most suitable stock research website:

- Long-Term Investors: If you’re a buy-and-hold investor focused on building a diversified portfolio, platforms like The Motley Fool and Morningstar are ideal. These websites emphasize long-term growth strategies and detailed company analysis, covering stocks, mutual funds, and ETFs suitable for long-term holdings.

- Short-Term Traders: Day traders or swing traders looking for quick gains from short-term price movements will benefit from TradingView or Finviz. TradingView offers advanced charting tools, real-time data, and social trading features. Finviz provides visual tools like heat maps and customizable stock screeners designed for quick, informed decisions based on technical analysis.

- Value Investors: Those who focus on fundamental analysis and the intrinsic value of stocks should consider Morningstar, Stock Analysis, or Zacks Investment Research. Zacks, with its proprietary Zacks Rank system, identifies potentially undervalued stocks through earnings estimate revisions, making it a go-to for data-driven insights and solid fundamentals.

- Growth Investors: If you’re interested in high-growth stocks with the potential for significant capital appreciation, Seeking Alpha’s Rule Breakers or Zacks Investment Research could be a great fit. These platforms provide access to stocks with considerable upside potential in favorable market conditions through growth-focused portfolios and deep research.

- Income Investors: For those seeking dividend income, platforms like Yahoo Finance, Morningstar, and Finviz offer detailed data on dividend-paying stocks, payout ratios, and income-focused investment strategies. Finviz also allows for screening based on dividend yield and other income-focused metrics.

2. Does the Platform Provide Accurate Information?

Accuracy is paramount in stock research. It’s essential to choose a platform that offers reliable, unbiased, and up-to-date information:

- Reputation for Credibility: Look for websites known for their data integrity and consistency. Morningstar has long been trusted for its rigorous research process and transparent rating system, while Zacks Investment Research is known for its data-driven approach focusing on earnings estimate revisions.

- Frequency of Updates: Platforms like Yahoo Finance, Koyfin, and Finviz Elite offer real-time data and news, ensuring investors access the most current information to make informed decisions.

3. Is It Worth the Cost?

While many stock research websites offer free access to essential data, premium plans often provide more value for severe investors:

- Evaluate the Premium Features: Assess whether the premium features justify the cost. For example, The Motley Fool’s Stock Advisor provides well-researched stock picks that have a strong track record of outperforming the market, which could be worth the subscription fee for growth-focused investors.

- Advanced Tools and Analysis: Consider whether you need access to advanced charting tools, proprietary research, or expert analysis that some paid plans offer. TradingView’s Premium plan offers extensive charting capabilities and custom alerts, while Finviz Elite provides real-time data, backtesting, and advanced screeners.

- Subscription Flexibility: Compare different subscription levels offered by each platform. Websites like Morningstar, Yahoo Finance, and Zacks Investment Research provide tiered subscription models that allow users to choose a plan aligning with their budget and research needs.

- Value for Money: Some platforms, like Koyfin, offer institutional-grade data and tools at a fraction of the cost of traditional terminals like Bloomberg, making it a compelling choice for those needing high-quality financial data without a hefty price tag.

4. Accessibility and User Experience

Usability and accessibility are also important considerations:

- User Interface: Platforms like Stock Analysis, Finviz, and Yahoo Finance are known for their user-friendly interfaces, making it easier for beginners to navigate and find the information they need.

- Mobile Compatibility: For those who prefer to manage their Portfolio and research on the go, platforms like Yahoo Finance or Seeking Alpha offer robust mobile apps that replicate essential desktop features.

- Customization Options: For investors who like to create personalized dashboards and track specific data points, platforms like Koyfin and Zacks Investment Research provide extensive customization options.

5. Community and Learning Resources

Being part of a community or having access to learning resources can significantly impact the decision-making process:

- Active Investor Communities: Platforms like Seeking Alpha and TradingView foster collaboration and idea-sharing among users, enhancing the research experience with community insights.

- Educational Content: Websites like The Motley Fool, Morningstar, and Zacks Investment Research provide a wealth of academic content, including articles, tutorials, and webinars, which are valuable for beginners and intermediate investors.

How We Choose the Best Stock Research Websites

Selecting the best stock research websites for 2024 involved evaluating key factors critical to investors. With numerous platforms offering various tools and features, it was essential to identify which sites deliver the most value based on user needs, data accuracy, ease of use, and pricing. Below are the criteria used to determine our top picks:

1. Data Accuracy and Reliability

The foundation of effective investment research is access to accurate and reliable data. We prioritized platforms known for their data integrity and consistency, such as Morningstar and Zacks Investment Research, which are trusted for their rigorous research methodologies.

2. Breadth and Depth of Research Tools

An excellent stock research website should offer a range of research tools catering to different investing styles. Koyfin and Zacks Investment Research provide robust analytics, while TradingView and Finviz excel in advanced charting and technical analysis tools.

3. User Experience and Accessibility

Ease of use, customization, and mobile access were considered. Platforms like Yahoo Finance and The Motley Fool are noted for their clean interfaces, while Koyfin and Zacks Investment Research offer extensive customization for advanced users.

4. Pricing and Value for Money

We assessed both free and paid plans to determine which platforms offer the best value. Koyfin and Finviz Elite provide premium features at a competitive price, making them cost-effective options for professional investors.

5. Community and Educational Content

Platforms like Seeking Alpha and TradingView with active communities were favored for fostering collaboration, while Morningstar and The Motley Fool were noted for their comprehensive educational resources.

Conclusion: Maximizing Your Investment Strategy in 2024

Choosing the best stock research website depends on your specific investing style, goals, budget, and research preferences. Whether you need real-time data, in-depth analysis, diverse opinions, or advanced charting tools, there’s a platform tailored to your needs.

Consider leveraging free trials and freemium models to test platforms before committing to a subscription. With the right tools aligned with your investment strategy, you can make more informed decisions, manage risks effectively, and potentially achieve better returns in 2024 and beyond.

Frequently Asked Questions (FAQ)

Choosing the best stock research website can be overwhelming, especially with the variety of features and services available. To help you better understand these platforms and make an informed decision, we’ve compiled a list of frequently asked questions (FAQs) that cover the most common concerns and queries investors may have.

Stock research websites are online platforms that provide investors with tools, data, and analysis to help them make informed investment decisions. These websites offer a range of features, such as real-time stock quotes, financial news, technical analysis tools, fundamental data, stock screeners, expert opinions, and quantitative models. They cater to different types of investors, from beginners to professionals, by offering insights into stocks, mutual funds, ETFs, and other financial instruments.

Stock research websites typically make money through subscription fees, advertisements, premium content, and affiliate partnerships. For example:

- Subscription Fees: Platforms like The Motley Fool, Zacks Investment Research, Seeking Alpha, and Morningstar offer premium plans that provide access to exclusive content, advanced tools, and expert analysis.

- Advertisements: Free platforms such as Yahoo Finance and Finviz may display ads to generate revenue while offering essential tools and news.

- Affiliate Partnerships: Some websites may earn a commission by promoting financial products or services, such as brokerage accounts or investment courses.

Yes, many free stock research websites are reliable and offer valuable tools and data. Platforms like Yahoo Finance provide real-time quotes, news updates, and essential analytical tools that are sufficient for many retail investors. Finviz offers a powerful free stock screener and visual tools such as heat maps. However, free websites may have limitations in terms of depth of analysis, data coverage, and advanced features. For investors looking for more in-depth research, premium subscriptions on platforms like Morningstar, TradingView, Zacks Investment Research, or The Motley Fool may be worth considering.

Absolutely. While some advanced stock research websites like TradingView, Koyfin, Zacks Investment Research, and Finviz may have a steeper learning curve due to their complex tools and data sets, they also offer tutorials, educational resources, and user communities to help beginners get started. Platforms such as The Motley Fool and Morningstar are particularly well-suited for beginners because they provide guided investment advice, stock recommendations, and easy-to-understand analysis.

The frequency of using stock research websites depends on your investment strategy and goals:

- Active Traders: Day traders and swing traders may need to use these platforms multiple times a day to access real-time data, charts, and alerts provided by platforms like TradingView and Finviz Elite.

- Long-Term Investors: Those with a buy-and-hold strategy might use these websites less frequently, perhaps a few times a week or month, to monitor portfolio performance and stay updated on market trends using platforms like The Motley Fool and Morningstar.

- Beginner Investors: Beginners should regularly use stock research websites to learn, research potential investments, and stay informed on financial news. Platforms like Zacks Investment Research and Seeking Alpha offer structured resources to help beginners understand the basics of investing.

For investors interested in international stocks and markets, the best platforms provide comprehensive global coverage:

- TradingView and Koyfin offer multi-asset coverage and global market data, making them excellent choices for international traders.

- Yahoo Finance provides news, data, and quotes from major global exchanges, making it useful for investors who want a broad overview.

- Morningstar also covers international mutual funds, ETFs, and individual stocks, providing in-depth analysis for global investors.

- Zacks Investment Research offers insights into global stocks through its quantitative models and earnings revisions.

Paid subscriptions on stock research websites can be worth it for investors who require advanced tools, detailed analysis, and exclusive content. For example:

- The Motley Fool's Stock Advisor and Rule Breakers have a strong track record of outperforming the market, providing high-quality stock recommendations.

- Zacks Investment Research Premium provides access to the Zacks Rank system, Focus List Stocks, and detailed earnings analysis that offers a quantitative edge.

- Seeking Alpha PRO offers exclusive content, quantitative ratings, and detailed earnings call transcripts that provide added value.

- Morningstar Premium provides access to proprietary ratings, in-depth analyst reports, and robust portfolio management tools.

The value of these subscriptions often depends on the individual investor's goals, experience, and the level of research required.

Yes, most stock research websites offer a free trial period or a freemium model where users can access basic features for free and upgrade to a premium plan later. For instance:

- Seeking Alpha, Morningstar, Zacks Investment Research, and Yahoo Finance provide limited-time access to their premium content.

- TradingView offers a free plan with essential charting tools, allowing users to test the platform before committing to a paid subscription.

- Finviz provides a free version with basic screening capabilities and visual tools, with an option to upgrade to Finviz Elite for more advanced features.

These trials are an excellent way to determine if a platform meets your research needs before investing in a subscription.

Last Updated on September 12, 2024 By Silvia Heart